which are prepaid costs when buying a home interim interest

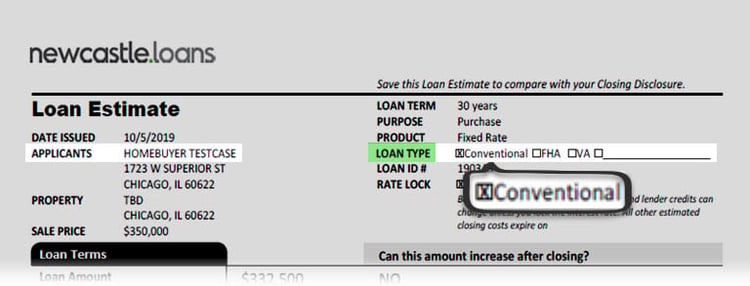

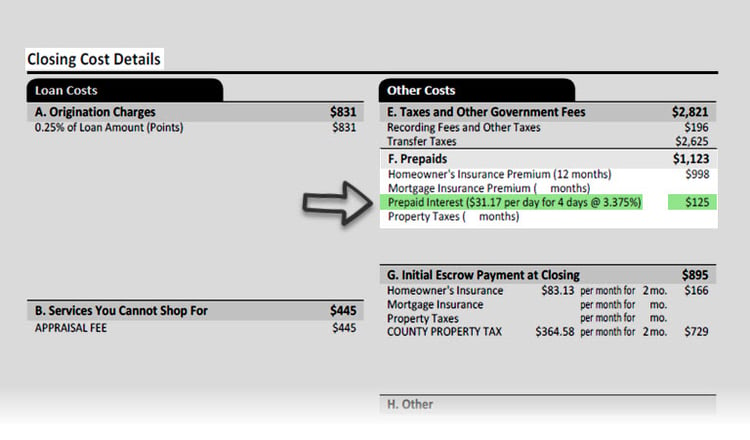

The final amount after the closing of the. At 3117 per day the prepaid interest cost her 125.

Prepaid Items Mortgage Escrow Account How Much Do They Cost

When it comes to mortgage loans there are several different types of prepaid items the most common are.

. Borrowers typically prepay interest when they take out a loan to either buy a home or refinance an existing mortgage. Sets with similar terms. There are lots of expenses associated with buying a home but dont worryprepaid costs are not extra costs.

As we noted earlier prepaid costs include. Calculating prepaid cost when buying a home is a very demanding task even with the help of apps like a mortgage loan payment calculator. Prepaids are normally required when a borrower puts down less than 20 percent.

At closing you should. The prepaid in prepaid costs doesnt. Prepaid costs when buying a home or prepaids are expenses that you would pay for anywayyoure just paying for them early.

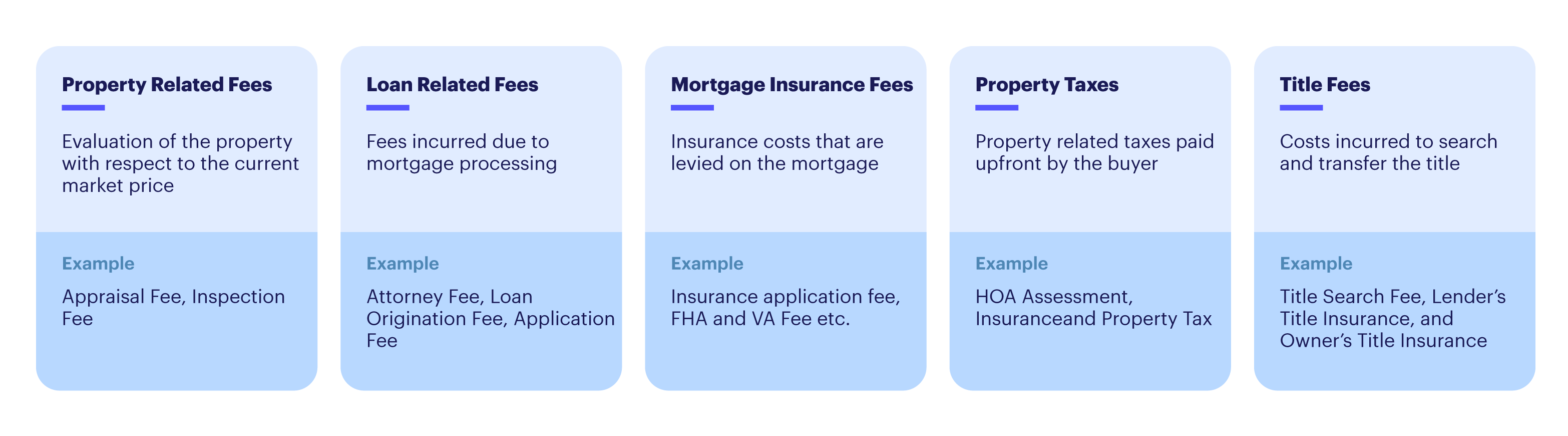

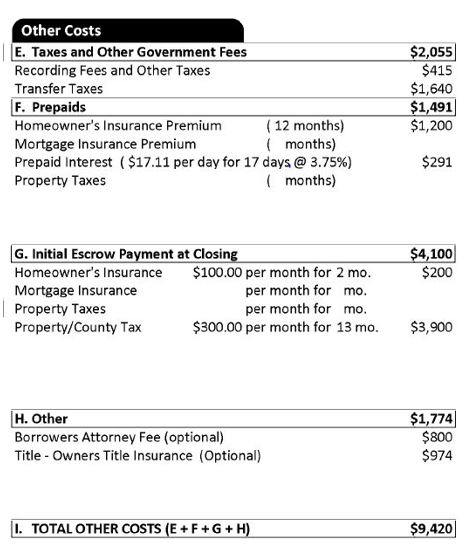

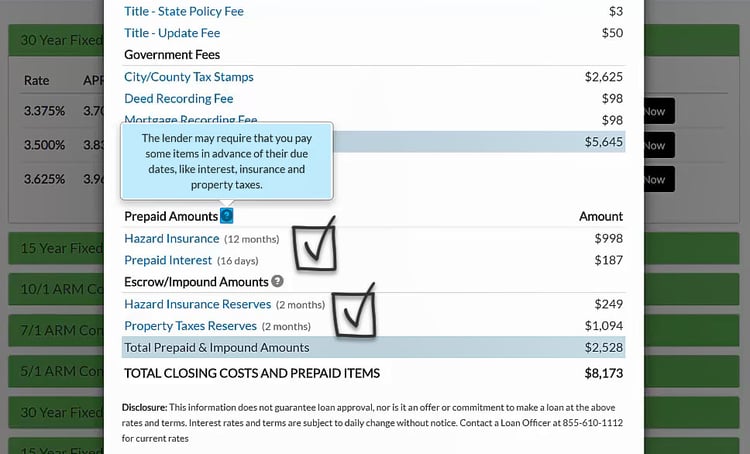

Prepaid costs are payments made at closing for upcoming line items of your new home loan. Prepaids are expenses the home buyer pays at closing before they are technically due. Prepaid costs usually include the homeowners insurance premium mortgage insurance premium if applicable property taxes and prepaid interest fees.

When buying a home what are the prepaid costs. When buying a home prepaid costs are payments made at closing that are used to cover future home-related expenses including mortgage interest homeowners. Which are prepaid costs when buying a home.

Although the home seller will sometimes cover closing costs as part of the sale agreement the buyer always pays the prepaid costs when buying a home. 12 months of homeowners insurance payments and two months additional for escrow reserves. Your prepaid costs can include.

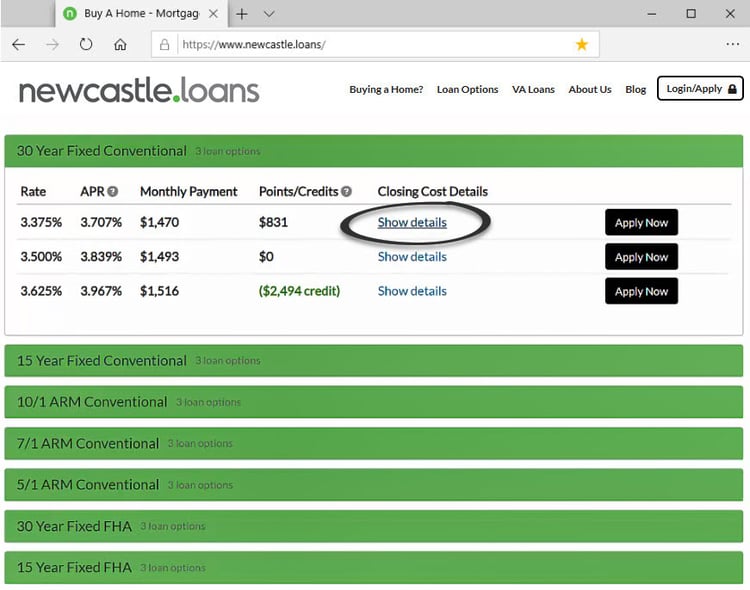

If buying a home or refinancing an existing mortgage prepaid interest will often be listed as a line item along with your other closing costs. Prepaid interest charges on a mortgage loan are the amount of interest you owe between signing the loan agreement and making your. Hope these answers will help you to take good pre-preparation.

Two months of real estate property. Theyre called prepaid costs because youre paying for them before they are technically due. Closing costs are fees for services rendered during.

As a borrower closes a deal they prepay the interest. Here are some frequently asked questions about prepaid costs when buying a home for the first time. Prepaid costs are the homeowners insurance mortgage interest and property taxes that you pay at closing when you buy a home.

Which Fees Are Prepaid Costs When Buying A Home Rocket Mortgage As at 19 November 2021 the premium had moved to 072The estimated NAV per share and mid-market. Personal Finance - Ch9.

Mortgage Closing Costs Vs Prepaids Bankrate

What Buyers Should Know About Saving On Prepaid Interest Aviara Real Estate

Closing Cost Assistance Program Citi Com

What Are Prepaid Costs When Buying A Home

Which Fees Are Prepaid Costs When Buying A Home Rocket Mortgage

What Is Prepaid Interest Charged By A Mortgage Company

Which Are Prepaid Costs When Buying A Home

Prepaid Items Mortgage Escrow Account How Much Do They Cost

What Are Prepaid Costs When Buying A Home

Everything You Need To Know About Buyer Closing Costs Elko Title Quoting Platform

How To Save Money On Closing Costs Find My Way Home

Understanding Closing Costs Sirva Mortgage

Let S Break Down Prepaid Mortgage Interest Mba Mortgage

Cost Of A Prepaid Loan Home Nation

Expenditures Of Federal Awards Sefa Schedule 16 Office Of The Washington State Auditor

Which Fees Are Prepaid Costs When Buying A Home Rocket Mortgage

Prepaid Items Mortgage Escrow Account How Much Do They Cost

Mortgage Closing Costs Explained In Detail Carolina Home Mortgage

:max_bytes(150000):strip_icc()/loanestimate3-7030e1c393dc47369eaeb519c61e2b6a.jpg)